Bank of Canada Just Cut Rates — So What Now?

Bank of Canada Just Cut Rates — So What Now?

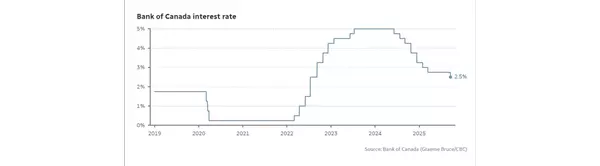

On September 17, 2025, the Bank of Canada (BoC) reduced its policy (overnight) interest rate by 25 basis points, bringing it to 2.5%, its lowest in three years. This is the first cut in six months. It’s meant to buffer a weakening job market, easing inflation pressure, and global trade headwinds (yes, tariffs still matter).

If you're in real estate in Greater Vancouver (buyer, seller, or investing), here’s how this shift might play out.

What This Means for Buyers

🟢 Some relief in mortgage costs

-

Variable-rate mortgage holders will see monthly payments drop somewhat; less stress (but still not cheap). Fixed rates may follow eventually (especially the short-term ones), though they lag behind variable rates.

-

Qualifying for a mortgage becomes marginally easier: lower interest = lower payments = slightly less income required to support the same mortgage. That helps first-time buyers or marginal cases. nesto.ca+1

🟢 More buyer activity likely

-

When borrowing is a little cheaper, some people who were on the sidelines—waiting for rates to fall, waiting out the market—may decide now is as good a time as ever.

-

More competition might creep in, especially in desirable neighbourhoods or for well-priced homes. So while you get help from lower rates, don’t assume you’ll always get a bargain.

⚠️ But still far from perfect

-

Affordability remains stretched in Greater Vancouver. Even with lower rates, home prices are high, down payments are large, property transfer costs are steep, and monthly carrying costs (taxes, insurance, maintenance) aren’t going away.

-

Fixed-rate mortgages may not fall much immediately—mortgage rates are tied to bond yields, lenders’ risk assessments, etc. So don’t expect a fire sale.

-

The stress test (the qualifying standard banks use) may still bite. Lower rates might ease the math but stress test calculations often assume a buffer that diminishes how much you “gain” from the drop.

What This Means for Sellers

🔴 Increased competition

-

As more buyers re-enter, there may be more demand, which is good. But also, more listings may follow as sellers who held off decide to test the market. That could moderate price gains.

🔴 Price pressure & timing matters

-

Sellers in high-demand areas may still do well, especially if their home is well maintained, well priced, and marketed well. But in lower-demand areas, or homes that need work, you might have to adjust expectations.

-

Homes that have been listed for a long time may get stale. Sellers will need to ensure their list price reflects market realities (i.e. take into account that buyers will compare aggressively).

🔴 Costs & carrying risk

-

If you’re holding a property, any reduction in vacancy, renting out, or carrying cost pressure helps. Lower financing costs help if you have adjustable rate debt or have to refinance. But many sellers also have fixed mortgages, so the benefit there is less direct.

-

If you were hoping to sell after interest rates drop further, there’s risk: more listings from others, possibly flat price gains if economic headwinds dominate.

Greater Vancouver-Specific Factors

-

Inventory has been low for years; that still limits how much buyers can move. If more listings come, that can ease pressure but it’s not a guarantee.

-

Foreign buyers / speculators / investment demand can amplify changes. If lower rates attract more investors, that could push prices up in some segments. Or a cooling market might discourage that demand.

-

Government policies & taxes matter. Vancouver is not “just a free market”—speculation taxes, property transfer taxes, zoning, and supply constraints will still shape what happens. Lower rates don’t fix supply shortages.

-

Affordability pressure remains extreme. Even small improvements in borrowing cost won’t solve the big issues (housing supply, income vs. home prices). Many buyers will still be priced out unless wages, supply, or other policy levers shift.

Bottom Line: Buyer Strategies & Seller Strategies

Here’s what I’d do (if I were you), depending on which side you’re on.

If you're a buyer:

-

Try to lock in variable if you believe rates will stay low or fall more; but hedge in case of surprises.

-

Shop around; lenders are likely to be more competitive.

-

Focus on what you can afford, including all hidden costs. Lower rates don’t erase big prices.

-

Be ready: good listings will sell faster as more buyers come back. Have your financing pre-approved.

If you're a seller:

-

Don’t overprice. Just because rates are down doesn’t mean buyers are irrational. Overpricing hurts more in a recovering market.

-

Tidy up: homes that show well will have an advantage. Buyers will be pickier as more options return.

-

Be realistic on negotiation. Expect more back-and-forth.

-

Time your listing wisely—if you can wait for more rate cuts or more positive economic signs, that might get more interest; but also watch out for more competition from other sellers.

Can Rate Cuts Fully Reset the Market?

To be blunt: no. A rate cut is a helpful tool, but it’s not a magic wand.

-

If employment keeps worsening, people will still be cautious.

-

Inflation, economic uncertainty, bond yields, global conditions, government policy all play big parts.

-

Supply constraints and land costs in Greater Vancouver aren’t going away. Unless you build more, faster, and remove friction (zoning, permits, etc.), affordability will stay a headache.

Forecast: What I Expect in GVA

Here are my predictions:

-

Sales volume will increase in the next 6-12 months as buyers respond to slightly cheaper financing.

-

Price growth will be modest—up in many neighbourhoods, flat or even slightly down in others (especially for homes needing updates, in less desirable locations).

-

Inventory will creep up: more sellers test the waters, more listings.

-

Margin for negotiation will improve in some sectors. Buyers might get better deals if they don’t stretch.

-

Policy moves may try to catch up: maybe more incentives for affordable housing, more pressure on developers to deliver supply.

Recent Posts

GET MORE INFORMATION